Legislative Update

Eviction Moratorium Expiration Talking Points

June 22, 2021

A few updates regarding the national eviction moratorium, slated to end on June 30th, 2021 ... or is it?

The National Apartment Association (NAA) has prepared the attached “eviction moratorium exit strategy” talking points ahead of the expiration of the CDC’s federal eviction moratorium on June 30th. The end of the moratorium, and what the eviction landscape will look like in the coming weeks, is getting wide media attention throughout the country and we hope that these talking points will not only help ensure a cohesive industry voice, but also provide a starting point for potential media inquiries and interview requests. Please reference these points as needed for your efforts – they can be used as written, or supplemented with state and/or local perspective to fit your needs.

While the moratorium is still officially set to end at the end of the month, there have been recent media reports that the Biden administration will extend the order by an additional month through the end of July. As always, the NAA communications team is always available should our assistance be needed. If you have any questions or concerns, please do not hesitate to reach out.

Eviction

As we approach the expiration of the CDC eviction order, all eyes are on the Biden Administration and what they may do in the face of mounting legal challenges, a start to return to normalcy in state economies around the nation and more than $46 Billion in rental assistance making its way to the street. Yesterday, the New York Times reported (story below) that the Administration is considering, among a number of strategies, a one-month extension of the order to “…buy more time to distribute emergency housing aid…” This is a common refrain amongst advocates and others who support, in their words, extending the order for as long as possible to get federal housing aid to renters in need and prevent a “tsunami” of evictions (in a related note, see this letter from 44 House Democrats urging the Administration to extend the CDC eviction order). We are encouraged that as the article also notes, Administration officials remain split on the issue because even 30 more days would allow the Supreme Court to rule against the CDC and “…affect executive actions during future crises.”

We won’t have a final decision in the DC District Court case (ALABAMA ASSOCIATION OF REALTORS et al v. UNITED STATES DEPARTMENT OF HEALTH AND HUMAN SERVICES et al) before June 30 but are hopeful that the Supreme Court will rule on lifting the stay on Judge Friedrich’s order soon. It’s a strategic play—will SCOTUS make a decision before June 30 or wait to see if the CDC moves to extend and respond by lifting the stay on July 1 (allowing evictions for nonpayment that are protected by the CDC order to be processed). The timing does work out for that to happen as decisions tend to come out on Thursdays or Mondays.

Such is the power of legal advocacy in which NAA and other real estate advocacy organizations continue to challenge the validity of the CDC Order. Additionally, NAA used both our grassroots and DC assets to urge Congress to press on the Administration to not extend the order any further and let some semblance of normalcy return to rental housing. You should expect the decision to extend the federal eviction moratorium to affect your advocacy at home. EvictionLab is helping renters’ rights advocates set up their case to extend state and local eviction protections in the event that the federal protection expires. To help you and your members have these conversations with elected officials at home on the CDC order and eviction moratoria in general, the NAA Communications team crafted the attached set of talking points as to why it is time to exit the CDC eviction order on June 30. Please use them and share any feedback you have.

Infrastructure

This week is a big go/no-go for the effort to come to an agreement on infrastructure between the Biden Administration and a “gang” of Democrat and Republican Senators, led by Rob Portman (R-Ohio) and Kyrsten Sinema (D-Ariz.). There are still big issues to solve in the roughly $1.2 Trillion deal, but it seems very possible and reportedly 11 Republicans are already on board. Many will celebrate the substance of this package in the face of the country’s declining roads, bridges, etc. Others will be pleased that there is still some ability to do bipartisan legislating in Washington. However, there is real fear amongst progressives in both Houses of Congress that if this deal is inked, it will take the steam out of a second package of so-called human infrastructure proposals including college tuition, expanded Medicare, climate change, paid leave and many other items. So concerned are they that assurances are being demanded (and given) from the White House that this second bill will move almost in tandem with the hard-infrastructure package.

For our part, it is not the substance of this second package that is of greatest concern; in fact, there could be over $200 Billion in spending for housing included. As is usually the case, it is the “pay fors” that are of greatest concern. NAA’s advocacy and that of many real estate organizations is to remind lawmakers of the damage that will be done by eliminating or severely curtailing 1031 “like-kind” exchanges, changing the treatment of capital gains, treating a carried interest as ordinary income or radically altering present law tax treatment of estates at time of inheritance. The Administration has shown interest in all of these ideas and much more, however, the tax writers in the House and Senate have yet to release any concrete plans and they are asserting their authority in this area, despite what the White House might want to do. NAA is part of several coalition efforts on these tax proposals. One of the more significant is in research to show the value and impact of 1031s and why damaging this important tool would be disastrous for housing economies large and small around the country.

We also continue to monitor both proposals for the inclusion of climate resiliency measures that could result in unfunded mandates to retrofit existing buildings and adding federal levers that would reduce the barriers to housing and encourage state and local governments to invest in housing infrastructure.

Remember you can keep up with NAA’s advocacy anytime through the following:

- Keep up with the progress of NAA’s federal advocacy on our new timeline and don’t forget to check out the newly updated tracking map which captures federal bills of interest to the industry as well as state-level housing policy trends. Local bill tracking coming soon!

- Tune into NAA’s Monthly Legislative and Regulatory Calls and encourage your members to sign up for the latest updates on NAA’s federal advocacy as well as state and local trends. Register today!

- Learn more about what changes to housing policy are happening around the country and what NAA and our affiliate partners are doing about it. A new issue is released monthly!

Thank you as always for everything you do for the industry.

DOWNLOAD -------> EVICTION MORATORIUM TALKING POINTS

Information courtesy of Greg Brown, National Apartment Association's Senior Vice President of Government Affairs

******************

The White House is considering extending by one month a federal moratorium on evictions scheduled to expire on June 30, in a bid to buy more time to distribute emergency housing aid, according to three people with knowledge of the situation.

The freeze, instituted by the Centers for Disease Control and Prevention last fall to stave off an anticipated wave of evictions spurred by the economic downturn during the pandemic, has significantly limited the economic damage to low-income and working-class renters, according to local officials and tenants' rights groups.

But the moratorium was never considered more than a stopgap, and landlords have prevailed in several recent federal court cases challenging the legal justification for the C.D.C.'s order - the public health risk posed by the dislocation of tenants during the pandemic.

Local officials have been bracing for a rise in evictions as the federal moratorium and similar state and city orders expire this summer. In some cases, that scramble to assist tenants has dovetailed with the broader goal of improving affordability that is now a core part of the Democratic Party's agenda.

On Monday, Gov. Gavin Newsom of California announced that the state had set aside $5.2 billion from federal aid packages to pay off the back rent of any tenant who fell behind during the pandemic, an extraordinary move intended to wipe the slate clean for millions of renters in a state dealing with acute homelessness and a housing affordability crisis.

President Biden's team has been seeking ways to speed up the sluggish distribution of $21.5 billion in emergency rental assistance allocated in the American Recovery Act this spring.

The group met throughout the weekend to discuss potential moves, including the idea of pushing back the deadline until the end of July, which has been under consideration for weeks, the officials said.

But they have yet to sign off on an extension, in part, over concerns in the White House Counsel's Office that leaving the freeze in place, even for a month, could expose the order to a ruling that could affect executive actions during future crises, one of the officials said.

Administration lawyers are particularly concerned that the Supreme Court will strike down a stay in a lower court decision that ruled the moratorium unconstitutional.

Mr. Biden's team is pushing ahead with several other actions, including issuing new guidance on using pandemic relief funds that could speed up distribution of payments by states, and increasing coordination with mayors, bar associations and legal services organizations.

But tenants' rights groups say that simply stopping the clock is the most important action.

"Extending the moratorium is the right thing to do - morally, fiscally, politically, and as a continued public health measure," said Diane Yentel, the president of the National Low Income Housing Coalition, who has pressed the White House for an extension. "Allowing evictions to proceed when there are tens of billions in resources to prevent them would be wasteful and cruel."

- Glenn Thrush

Joint CFPB/FTC Letter on Notification of Eviction Protection

May 3, 2021

The National Apartment Association wanted to make sure that you saw the attached letter issued today jointly by the CFPB and FTC to “Landlord/Property Management Companies” regarding “Preventing Illegal Evictions During the COVID-19 Pandemic.”

Also, as a follow up to my note last week regarding tax proposals from the Biden Administration that will impact the rental housing industry, we now understand that we will see detail and specifics on these (and any others not included in the release of the “American Families Plan”) when the Treasury Department releases its annual “green book.” This document summarizes all revenue proposals that are part of the Administration’s annual budget proposal, but has not been used since the Fiscal Year 2017 budget. To be released in late May, this explanation should help answer outstanding questions about the Administration’s plan and, as a practical matter, will extend the legislative process around the tax package. Stay tuned.

Information courtesy of Greg Brown, National Apartment Association's Senior Vice President of Government Affairs

CFPB Rule Clarifies Tenants Can Hold Debt Collectors Accountable for Illegal Evictions

April 19, 2021

Bureau Issues Interim Final Rule on Fair Debt Collection Practices Act

On April 19, the Consumer Financial Protection Bureau (CFPB) issued an interim final rule requiring “debt collectors” to provide written notice to renters of their rights under the CDC’s eviction moratorium order and prohibiting "debt collectors" from misrepresenting renters’ eligibility for protection from eviction under the moratorium. The rule will go into effect on May 3 and last through the duration of the CDC Order, which was recently extended through June 30, 2021.

To understand whether the rule applies to you, it is important to note the CFPB’s definition of “debt collector,” derived from the Fair Debt Collection Practices Act (FDCPA). According to the CFPB, under the FDCPA:

[The interim final rule requirement] may include lawyers who represent landlords or property managers in eviction court to collect unpaid rent, if they start collecting the debt for [a renter’s] landlord after [renters] fall behind on [their] payments.

We understand that there are other considerations as well, including relevant case law that may be more conclusive about whether property managers or management firms are categorized as “debt collectors,” and whether state eviction laws and court processes separate the process to recover possession from actions to cover outstanding rent debt.

We highly encourage all NAA members to seek the advice of a local attorney before proceeding with an eviction to understand whether CFPB’s rule applies.

As an added protection, we suggest all members consider adding the CFPB’s sample disclosure language to your eviction notice. For NAA members who participate in NAA Click & Lease, we are adding a form that contains similar disclosure language for users. Additional resources and compliance training are forthcoming, as well.

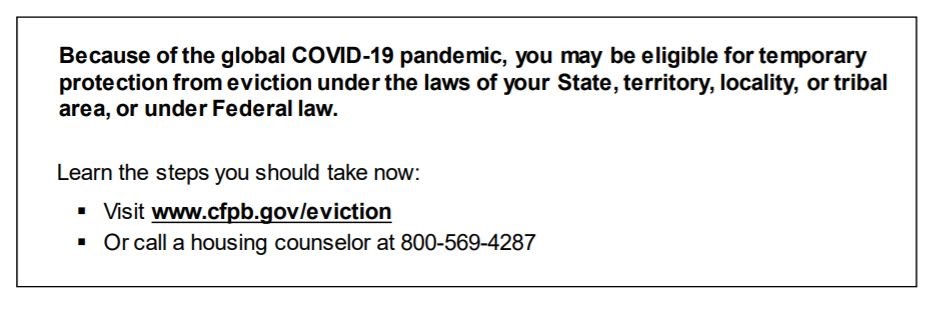

CFPB’s Sample Language:

The CFPB’s rule is an unfortunate expansion of the CDC’s Order, and we are continuing conversations with the Administration and federal agency officials about the ongoing challenges that rental housing providers face while the CDC Order and related federal requirements remain in place. In addition to being bad public policy, these efforts make compliance difficult in an area where there is already an abundance and patchwork of legal requirements complicating the CDC’s Order. This interim final ruling only adds to the confusion as federal, state and local eviction moratoria are being applied very differently in courts across the country.

It is time to end federal efforts that interfere with the eviction process. NAA will continue combating these policies and shift focus to the distribution of the almost $50 billion of federal rental assistance.

CDC Releases Updated FAQs

April 14, 2021

The CDC finally released its updated FAQs regarding the agency’s federal eviction moratorium order, which was extended until June 30.

Of note:

- The FAQs confirm that the Order temporarily halts residential evictions of covered persons for nonpayment of rent from September 4, 2020, through June 30, 2021. However, the Order is not intended to terminate or suspend the operations of any state or local court. Nor is it intended to prevent housing providers from starting eviction proceedings, provided that the actual physical removal of a covered person for non-payment of rent does NOT take place during the period of the Order.

- The FAQs make clear that rent is still owed. The CDC Order does not cancel rent. Renters must still fulfill their obligation to pay rent and follow all the other terms of their lease and the rules of the place where they live. Renters must use their best efforts to make timely partial payments that are as close to the full payment as their individual circumstances permit, considering other nondiscretionary expenses.

- When the Order expires, consistent with the applicable landlord-tenant or real-property laws, renters still owe their housing provider any unpaid rent and any fees, penalties, or interest as a result of their failure to pay rent or make a timely housing payment during the period of the Order.

- Covered persons may use any written document in place of the declaration form if it includes the required information in the form or uses a form translated into other languages. The CDC has released an updated form in English as well as translations in other commonly spoken languages.

- While housing providers maintain the ability to move forward with eviction for lawful reasons other than nonpayment of rent, individuals who are confirmed to have, have been exposed to, or might have COVID-19 and take reasonable precautions to not spread the disease should not be evicted on the ground that they may pose a health or safety threat to other residents.

- The FAQs also note that if a renter has declared that they are a covered person under the CDC Order, but the housing provider does not believe the renter actually qualifies, the Order does not preclude a housing provider from challenging the truthfulness of a renter’s declaration in any state or municipal court.

- The FAQs provide comments on whether housing providers are required to make their residents aware of the CDC order and Declaration.

- The Order itself does not require housing providers to make renters aware of the Order and Declaration. But other relevant law, for instance, the Fair Debt Collection Practices Act and the Federal Trade Commission Act, may require “landlords, or their agents,” to do so. Under these statutes, evicting renters in violation of the CDC, state, or local moratoria, or evicting or threatening to evict them without apprising them of their legal rights under such moratoria, may violate prohibitions against deceptive and unfair practices. Housing providers must otherwise comply with all requirements of the Order. Also, even if not legally required, housing providers are encouraged to tell their residents about the Order.

- Finally, the FAQs make clear how the federal government intends to enforce the Order, including a reference to the Consumer Financial Protection Bureau (CFPB) and the Federal Trade Commission (FTC) announcement that they will step up enforcement efforts against housing providers, and that housing providers remain subject to jail time, fines and penalties for violations of the Order, both on an individual and an organizational basis.

An all member alert will go out shortly, and we are working on updating NAA’s member guidance in line with these changes.

As always, thank you for everything you do for the industry. We will keep you apprised of new developments.

Information courtesy of Nicole Upano, National Apartment Association's Director of Public Policy

treatment of emergency rental assistance for purposes of calculating income

March 29, 2021

No, I am not writing to tell you that the CDC has officially extended the eviction order (even though as of AFTER this informational piece was written, it now has been extended through the end of June). I am writing to flag for you information, presented in the form of frequently asked questions, out of the Treasury Department regarding the treatment of emergency rental assistance for purposes of calculating income. The key takeaways are the following (language in italics is mine):

- Emergency Rental Assistance payments made to eligible households are not considered income to members of the household.

- Emergency Rental Assistance payments, including payments for utilities or home energy expenses, made to eligible households are not considered income to members of the household.

- Emergency Rental Assistance payments made on behalf of an eligible household (to a landlord directly) are not considered income to members of the household.

- Rental payments you (the landlord) receive, whether from your tenant or from a Distributing Entity on your tenant’s behalf through a Section 501 Emergency Rental Assistance program, are includible in your gross income.

- Utility payments your company (the utility company) receives, whether from a customer or from a Distributing Entity on the customer’s behalf through a Section 501 Emergency Rental Assistance program, are includible in your company’s gross income.

We will be back in touch as more developments warrant.

Information courtesy of Greg Brown, National Apartment Association's Senior Vice President of Government Affairs

GIAA Legislative Update

February 22, 2021

This week was the sixth week of the 2021 session. There are two weeks left until the first funnel deadline. Iowa’s system creates two specific deadlines that narrow the focus of bills, ensuring that only bills with broad bipartisan support or strong majority support continue to be eligible for debate.

The first funnel deadline is March 5. By that date, a bill must be out of its committee of jurisdiction or it technically dies. There are exceptions to this rule; for example, it does not apply to tax or appropriations bills, nor does it apply to bills sponsored by leadership or the Government Oversight committees. Also, a dead bill can be resurrected as an amendment to a bill that deals with the same or similar subject matter. These deadlines allow lawmakers, staff and the lobby to focus on fewer policy bills as the session progresses, allowing more time to discuss the budget and tax proposals.

The Iowa Senate on Wednesday passed SF 252, a bill that would prohibit cities and counties from requiring landlords to accept a Section 8 housing voucher as a source of income. GIAA supports this bill, which would preempt ordinances in Marion, Des Moines and Iowa City. GIAA believes that it should be left to a landlord to determine whether to accept the voucher. The bill passed on a party-line vote 31-18 in the Senate. The House Local Government Committee is scheduled to debate the companion bill next week.

Occasionally we see bills introduced that should remind all of our members the importance of the work that GIAA does at the Capitol, and this week is no exception. SF 397, introduced this week in the Senate Local Government Committee, would open landlords up to criminal liability if they did not “mitigate mold discovered during a rental inspection .... within a reasonable time”. GIAA opposes this bill, as it is incredibly vague (What types of mold? What is a reasonable amount of time?) and incredibly draconian (Does a landlord get due process? Is it a strict liability crime like a speeding ticket?).

Information courtesy of Michael Triplett, Greater Iowa Apartment Association's Lobbyist

updates on where things stand on COVID relief efforts in DC

February 10, 2021

First, we are one significant step closer to seeing the COVID bill move through budget reconciliation. The House and Senate both passed budget resolutions on Friday which included reconciliation instructions for Congressional Committees to now draft legislation with all of the specific policy items to be included in the bill. The House Financial Services Committee was allocated $75 billion to use for statutory changes within its purview. The Committee will mark up its bill on Wednesday, February 10.

Here is what will be in it:

- $10 billion for Defense Production Act spending.

- $25 billion for Emergency Rental Assistance.

- $19.05 billion goes to Treasury’s Emergency Rental Assistance Program (ERAP) and utility assistance efforts.

- $5 billion for emergency Housing Choice Vouchers

- $100 million to support struggling unassisted households living in USDA-subsidized properties.

- $750 million to support the Indian Housing Block Grant program and the Indian Community Development Block Grant programs.

- $100 million in funding for NeighborWorks to support housing counseling services.

- $5 billion for Homelessness Funding.

- $10 Homeowner Assistance Funding.

- $10 billion for the State Small Business Credit Initiative.

- $15 billion to Support Workers in the Airline Industry.

You will note that the CDC eviction order is not here. Since there is no federal revenue impact by extending the order, we believe it cannot be included in a budget reconciliation bill, though someone could attempt to argue otherwise. Realistically, any extension will have to be done through executive action or negotiated agreement with Republicans on the COVID package. Based on body language amongst Congressional leaders and the President, it is safe to say that the former is much more likely than the latter.

The other House and Senate Committees will be doing the same work as House Financial Services in the next two weeks. Federal unemployment benefits expire on March 14 and Senate and House leadership say they want a COVID bill passed by late February to early March to ensure there is no gap in support.

Second, on the ERAP program, attached is a letter from our real estate coalition to the Administration outlining what we see as priorities for the new guidance the department will issue to support the deployment of the $25 billion ERAP program. This is based upon feedback from the field about previous COVID rental assistance programs and, in part, as a direct response to efforts by the activist community to essentially rewrite the program through regulation.

Third, attached is a letter from our real estate coalition focused on the CDC order itself, specifically the letter restates our contention that the Order should not be extended and rebuts claims by the activist community that the order is full of “loopholes” and that large portions of it should be stripped out in order to establish an “automatic and universal” eviction ban. We got word on Friday that there will be an opportunity for all of our organizations to weigh in directly with key staff working on the CDC order as soon as this week.

That is all from the policy side of things. I recommend to you this ARTICLE from the New York Times on the limits of eviction moratoriums and the segment of renters living under information arrangements. Worth your time.

Information courtesy of Greg Brown, National Apartment Association's Senior Vice President of Government Affairs

Why eviction moratoriums are bad for affordable housing

There is pressure mounting on cities (like DSM) to extend eviction moratoriums or enact rules that make it very tough on housing providers. Brought up multiple times in the Des Moines city council meeting on August 17, 2020, where groups are putting pressure on DSM to enact new measures.

Benchmarking

ORDINANCE NO. 15,779

Last year, the city of Des Moines passed a benchmarking program that will be a significant cost driver for housing providers. It requires providers to get usage data on each and every utility meter in their buildings (including tenant-controlled meters that do not have easy access) and hand input meter data for every meter, every month of the year. An independent company estimates the cost of this at around $144, per meter, per year. An average apartment building has 27 meters in it. This cost must be passed on to tenants in higher rents.

READ MORE...>>

Review to Amend 661—Chapter 210

PUBLIC SAFETY DEPARTMENT

Notice of Intended Action

Proposing rulemaking related to smoke alarms and detectors and providing an opportunity

for public comment

The State Fire Marshal hereby proposes to amend Chapter 210, “Smoke Detectors,” Iowa

Administrative Code.

READ MORE...>>

Any interested person may submit written or oral comments concerning this proposed rulemaking.

Written or oral comments in response to this rulemaking must be received by the Department no later

than 4:30 p.m. on August 10, 2020.

Comments should be directed to:

Daniel Wood

State Fire Marshal Office

Department of Public Safety

Oran Pape State Office Building

215 East 7th Street

Des Moines, Iowa 50319

Phone: 515.725.6150

Email: wood@dps.state.ia.us